Ombudsman halts Fishrot accused transfer to public cells

Erasmus Shalihaxwe and Ester Mbathera

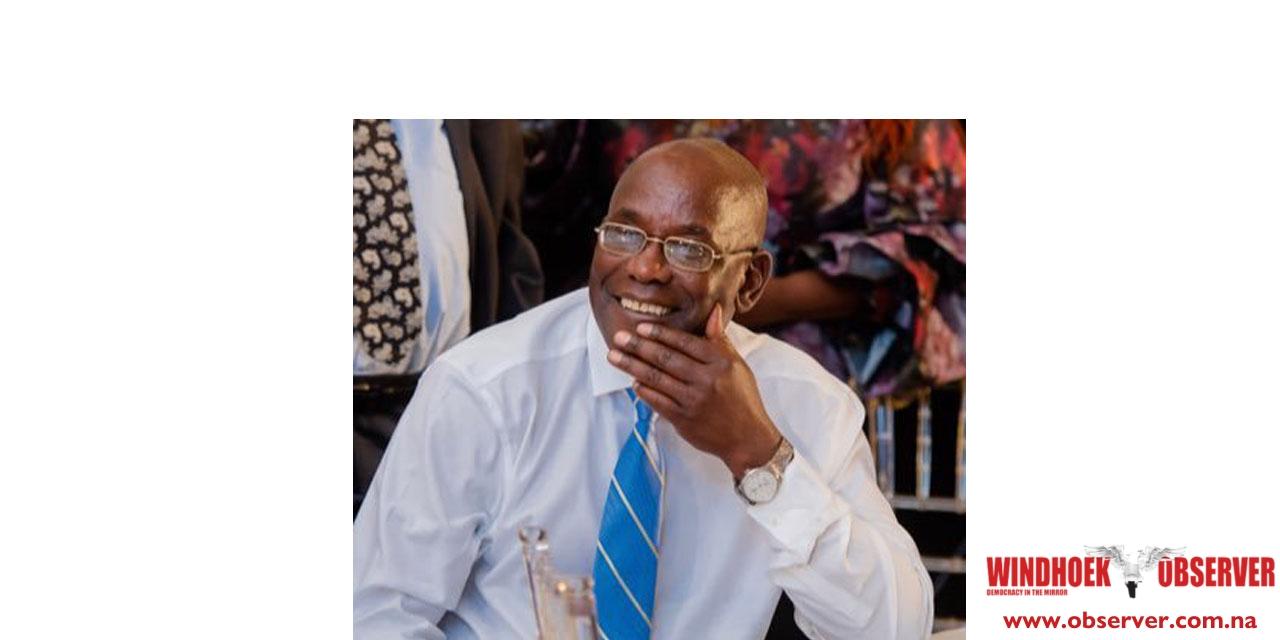

Namibia’s Ombudsman, Basilius Dyakugha has ordered the Namibia Correctional Services (NCS) to put plans to transfer some of the Fishrot accused to other holdi...